Texas Senate Refuses To Pass Largest Tax Cut Ever

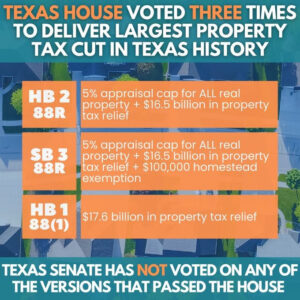

This year, the Texas House passed historic tax cuts only to see the bills wither and die in the Texas Senate. Two of those bills, HB 2 and SB 3, passed during the regular session. HB1 passed during Special Session #1 in less than 24 hours from the start of the call.

HB 2 was House’s original plan. This bill would have compressed, or bought down, the school district M&O property tax rate AND capped all appraised value growth at just 5%. Currently, homesteads are capped at 10% and commercial properties, including rental houses, have no cap. The Senate soundly rejected this plan because they refused to negotiate on appraisal caps.

SB 3 was the Senate’s property tax plan, which included some compression and a larger homestead exemption. The House added the appraisal caps at 5% and sent it back over to the Senate, where it was rejected once again. The Texas Senate clearly doesn’t believe appraisal growth is an issue and will not negotiate on this point. They want to keep the appraisal districts operating as-is.

Once the regular session concluded with money budgeted for property tax relief but no enabling legislation to direct the funds, Governor Abbott immediately called us back for Special Session #1 to specifically address property taxes with compression only – the only common denominator between the two plans.

The Texas House passed this new bill within 24 hours and sent it over to the Senate, where it must pass before heading to Governor Abbott’s desk to become law. Again, this tax cut, totaling $17.6 billion, is not only the largest tax cut in Texas history, but the largest state tax cut in US history. This tax cut would reduce your school district M&O tax rate – the largest property tax you pay each year – by 26% and would put us on a pathway to completely eliminating this tax altogether before the end of this decade.

The House was able to pass this historic tax cut within 24 hours. It’s past time for the Texas Senate to get to work and pass this bill over to Governor Abbott’s desk!

What is compression?

Good question! Tax compression was most recently done in the tax reform bill passed in 2019. Then, we allocated about $5 billion to reduce property taxes between 7 – 11 cents per $100 in valuation, depending on the district.

How it works: Texas public schools are funded through both local property taxes and state funds. Generally speaking, the more local districts charge property taxpayers, the less the state chips in to make them whole. However, with compression, the state injects new state funds (largely sales tax revenue) to offset local property taxes. The result is that districts remain whole, but the state picks up a larger percentage of the funding and caps the tax rates at a lower number so they cannot be raised later.

In this case, the state is attempting to inject $17.6 billion to reduce those taxes around 26%. Studies show that if we continue to use excess funds in this manner, we may be able to completely eliminate the school district M&O property tax by the end of the decade – thus eliminating the largest portion of your annual tax bill.

Politics not policy

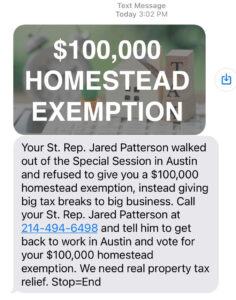

The Senate is going all out to oppose Governor Abbott’s and the Texas House’s plan to enshrine the largest state tax cut in US history into Texas law – providing all taxpayers with significant relief. On policy, our plan works. However, the Texas Senate is now pushing a text message and social media campaign lying to voters about the record of Texas House Members. Here is a text message sent yesterday in HD 106 and other districts:

What’s the truth?

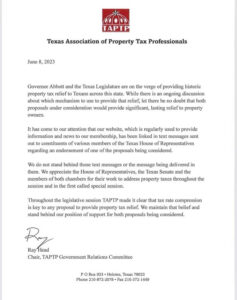

The truth is, the Texas House adjourned after passing this tax cut and the other bill on Governor Abbott’s call because that’s all we can legally do in a special – pass bills that are on the call. But what’s worse, the lying text sent to some Republican voters wasn’t even done with the approval of the organization they attempted to reference. It took just minutes for the organization to distance themselves from the lying texts and claim their neutrality on both plans:

But I like a homestead exemption!

I do, too. Increasing the homestead exemption from $40,000 to $100,000 – which the Texas House passed in SB 3 during the regular session in an attempt to negotiate with the Senate – sounds great. However, without tighter caps on the appraised value of your home, those exemptions will be completely eaten up by higher values in no time. Since the Texas Senate refuses to lower appraisal caps at all, the Texas House shouldn’t agree to spend state funds on a higher homestead exemption.

It would be nice to have both for now – but if we remain on this track to completely eliminate this tax altogether then it wouldn’t matter if you had a homestead exemption for school taxes anyway (because the tax wouldn’t exist, therefore no exemption necessary). Further, every dollar we spend on increasing the homestead exemption now, is one less dollar we have to spend on eliminating this tax. Just as the Republican platform calls for, Governor Abbott’s and the Texas House’s plan dramatically reduces and could eventually eliminate the school district M&O property tax – the largest property tax you pay each year.

The good news:

The good news is that while Congress continues to increase the debt ceiling and spend our great grandchildren’s money, the biggest argument at the state level is how best to return billions of dollars to you – the taxpayer.

Still, we must have the Texas Senate act immediately without delay. You deserve your tax dollars returned and this tax cut – the largest ever – needs to happen ASAP. Please feel free to contact your State Senator or the Lt. Governor’s office today and let them you know you expect Governor Abbott’s and the Texas House’s tax cut, the largest ever, to be passed TODAY!

You can Learn More by clicking HERE